Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

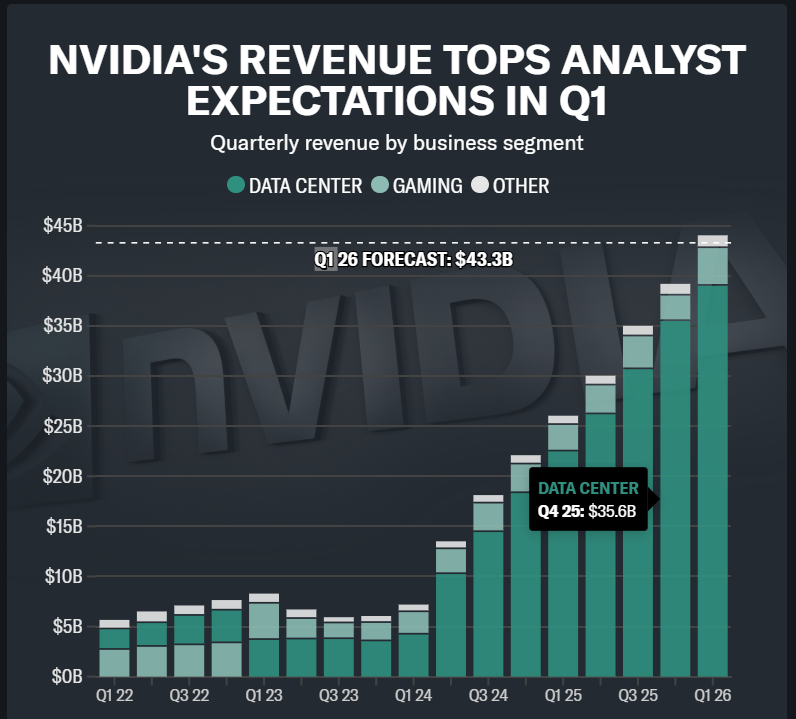

Nvidia earnings report 2025: Overall revenue grew 69% during the quarter, and sales in the company’s data center division, which includes AI chips and related parts, grew 73%.

Nvidia (NVDA) has become the poster child for the AI boom that kicked off in late 2022 reported mixed first quarter results after the close on Wednesday.

Nvidia earnings, the AI hardware giant reported revenue of $44.1 billion for the quarter, topping analyst estimates of $43.3 billion, according to data compiled by Bloomberg. Nvidia reported $26 billion in the same period last year.

Adjusted earnings per share, excluding the charge for the H20 chips, were $0.96, beating estimates for $0.93 and surpassing earnings per share of $0.61 last year.

Data center revenue fell slightly short of estimates, coming in at $39.1 billion versus $39.2 billion estimated and $22.5 billion last year.

The company also called out an $8 billion revenue hit related to China export rules in the second quarter. In an interview last week, Nvidia CEO Jensen Huang said the company had lost $15 billion in sales as a result of these rules..

During the quarter, the U.S. government informed Nvidia that its previously approved H20 processor for China would require an export license. Nvidia said it incurred $4.5 billion in charges related to excess inventory for the chip, and would have recorded $2.5 billion in extra sales if the chip hadn’t been restricted.

Nvidia said its gross margin of 61% for the quarter would have been 71.3% if not for the China-related charge.

“The $50 billion China market is effectively closed to US industry,” Nvidia CEO Jensen Huang said. “The H20 export ban ended our Hopper data center business in China. We cannot reduce Hopper further to comply.”

“We are exploring limited ways to compete, but Hopper is no longer an option,” Huang continued. “China’s AI moves on with or without US chips.”

Based on extended trading, Nvidia shares are now less than 5% below their record high reached in January and are at their highest in four months.

Nvidia earnings in gaming division, which includes its chips for playing 3D games, grew 42% on an annual basis to $3.8 billion. Nvidia primarily made gaming chips before its semiconductors became essential for AI. It still makes the processor at the heart of the new Nintendo Switch 2 console. But its gaming chips can also be used for AI applications.

Nvidia earnings in the automotive and robotics division reported sales growth of 72% to $567 million. Nvidia attributed the rise to additional sales of its chips and software for self-driving cars. The company’s professional visualization business, which comprises chips for 3D design, as well as the company’s recently released DGX Spark and DGX Station desktops for AI, grew 19% to $509 million in revenue during the quarter.

Read more about Tech & startups

[…] Learn more about stock market and investment opportunities […]